2025 AI Home Appliance Trends Report

According to the “AI Home Appliance Trend Report 2025” released by Opensurvey, consumers show high expectations for AI-powered appliances, citing convenience and time-saving benefits. However, concerns over high prices and privacy risks remain strong. Despite the growing presence of AI features such as voice control and automation, adoption is still under 10%, revealing both market potential and structural barriers.

High Interest, Low Adoption: Cost and Privacy Still Block Widespread Use

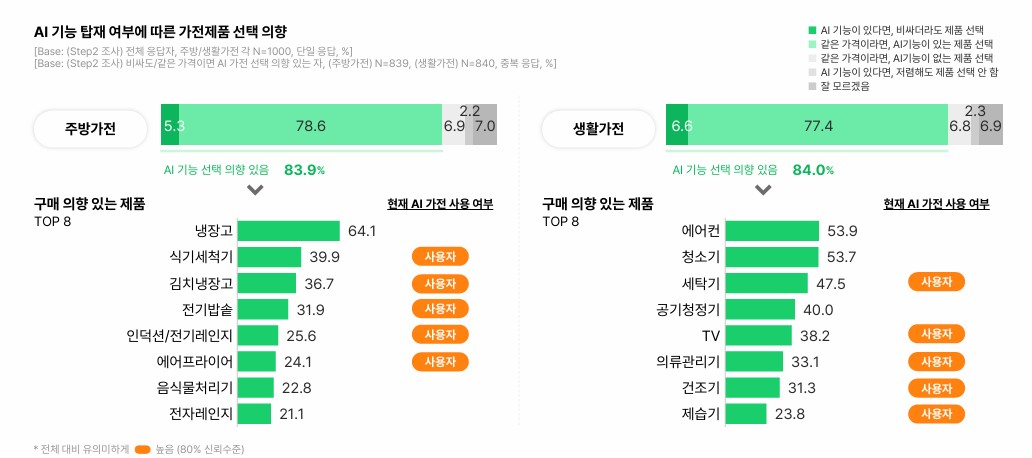

A survey of 1,500 Korean adults aged 20–59 revealed that 83.9% would prefer an AI-enabled appliance if priced the same as a standard one. However, actual usage sits below 10%. The biggest concerns are cost and data security. Notably, women in their 40s and 50s were more likely to find AI appliances difficult or complex, suggesting a need for more user-friendly designs.

Women More Likely to Associate AI with Voice Control and Automation

Consumers tend to define AI appliances as devices that operate autonomously or respond to context. Women showed significantly higher awareness of features like voice and mobile control. The most recognized AI functions were self-diagnostics (68.2%) and automatic shutdown in dangerous situations (66.8%), showing that consumers value proactive and safety-oriented technologies.

Split Views on AI: Optimists vs. Skeptics

About 41.1% of respondents were categorized as “positive adopters” with high expectations and low concerns, while 39.7% were “cautious adopters” with both high hopes and high worries. Desired benefits include more free time, personalized operations, and easier mobile controls. Main concerns remain cost and privacy, along with complexity—especially among older female consumers.

Beyond Chores: Consumers Open to Health and Wellness Features

A majority of respondents (72.6%) said they’re comfortable with AI appliances handling repetitive chores. Additionally, 66.4% would allow appliances to determine operating modes. Interestingly, 51.0% supported AI playing a role in personal wellness, such as sleep tracking or medication reminders. On average, AI users identified more accepted use cases than non-users, suggesting experience fosters openness.

Preferred future features include proactive status alerts (59.0%), context-aware operation (49.7%), and auto eco-mode for energy savings (46.6%)—indicating demand for preventive and intelligent automation.

AI Adoption Higher in Living Appliances Than in Kitchen Devices

Among current AI appliance users, 80.5% of living appliance users and 76.8% of kitchen appliance users reported noticeable benefits. The most appreciated feature was easier operation—cited by 51.0% of living appliance users and 38.6% of kitchen users. Time savings followed closely.

Living appliance users also reported higher psychological satisfaction (28.8%) and stress reduction (24.7%) compared to kitchen appliance users. Remote control via mobile was the most commonly used function, followed by automatic sensing.

FAQ

Q: What defines an AI-powered appliance?

A: These appliances use artificial intelligence to recognize user behavior or context and operate autonomously. They often support voice and mobile control, self-diagnosis, and personalized functions.

Q: Why are consumers hesitant to buy AI appliances?

A: The top reasons are high prices and concerns about personal data leakage. Many also worry that AI features are too complex—especially women aged 40 and up.

Q: What’s the market outlook for AI home appliances?

A: Though adoption is currently low (~10%), demand is high—8 in 10 would choose AI features if price were equal. Interest in subscription models also exceeds 70%, indicating strong growth potential.

The full report is available on Opensurvey.

Image source: Ideogram-generated

This article was produced using ChatGPT and Claude.

![[AI 시대 마케팅 대전환] 클릭은 죽었다. AI의 인용이 곧 트래픽이다.](https://aimatters.co.kr/wp-content/uploads/2025/06/AI-Matters-기사-썸네일-1.jpg)