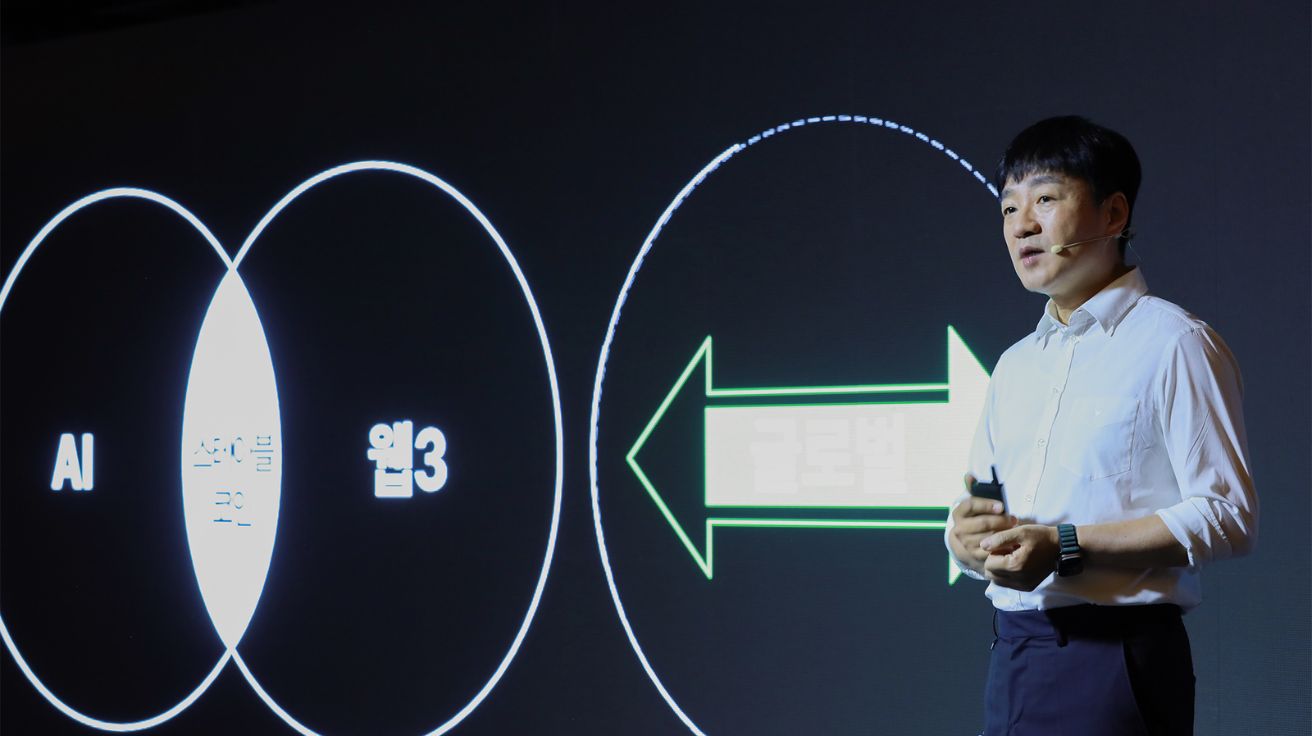

Naver Pay (Npay) announced plans on June 26 to transform into a top-tier global fintech platform by leveraging artificial intelligence (AI) and Web3 technologies. During its “Npay Media Day 2025” event held at the Four Seasons Hotel in Seoul, the company unveiled its long-term strategy for the next decade.

“Npay has driven the growth of Korea’s e-commerce and fintech markets over the past 10 years. The next decade will be defined by its evolution into a world-class fintech platform,” said Park Sang-jin, CEO of Naver Pay.

According to the company, 85% of South Koreans in their 20s to 60s have used Naver Pay, with cumulative transaction volumes reaching KRW 328 trillion (approximately USD 235 billion) over the past decade. Building on this user base, Naver Pay plans to launch its offline payment terminal “CONNECT” later this year. CONNECT will support a comprehensive range of payment options, including traditional cash and card payments, as well as QR, MST, NFC, and facial recognition-based “FaceSign” payments. Merchants can activate CONNECT simply by upgrading their existing payment software systems.

In line with regulatory developments, Naver Pay also revealed plans to actively pursue the development of a Korean won-pegged stablecoin. “Stablecoins pegged to the won will become a key instrument of digital finance that transcends borders,” Park stated. “We intend to play a leading role within industry consortiums as new policies emerge.”

The company is also expanding its AI-powered services. Last week, it unveiled “AI Home Finder,” based on large language model (LLM) technology, and “Money Briefing,” which provides users with real-time insights into their financial assets. Its data science capabilities are also demonstrated through the alternative credit assessment system known as the “Npay Score.” According to Naver Pay, 30% of users of its loan comparison service have benefited from better interest rates and credit limits thanks to this scoring system. Those who used Npay Score saw their approval rates rise by an average of 20 percentage points, while default rates fell by 1.4 percentage points.

Naver Pay currently handles approximately 13 billion transactions annually, with peak processing rates of up to 25,000 per minute. The company estimates that its fraud detection system (FDS) will block fraudulent payments totaling KRW 3 trillion (USD 2.15 billion) this year.

This article was originally published in Korean via Naver Newsroom. Read the original article here.

Naver Pay Unveils Ambitious Strategy to Become a Global Fintech Powerhouse with AI and Web3

Image Credit: Naver

관련 기사 더보기